The Hong Kong Insurance Authority (HKIA) is set to implement fees for the processing of insurance intermediary licence applications and related notifications, effective 23 September.

This new fee structure, aimed at recovering regulatory costs, will mark the end of a five-year fee waiver period that commenced when the HKIA assumed responsibility for regulating insurance intermediaries on 23 September 2019.

The introduction of these fees follows comprehensive consultations with industry stakeholders, ensuring that the charges accurately reflect the HKIA’s regulatory expenses without exceeding them.

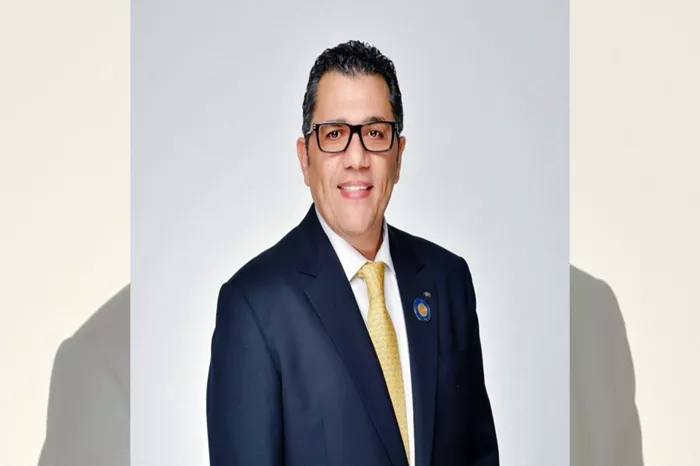

Peter Gregoire, Head of Conduct Supervision Division and General Counsel of the HKIA, explained that the fees will support the Authority’s regulatory functions, including on-site inspections, offsite monitoring, and the upkeep of its technology-driven licensing system.

Moreover, revenue generated from these fees will be allocated to bolster public education initiatives, provide training for insurance professionals, and reinforce enforcement measures to uphold market integrity.

To facilitate the payment process, the HKIA has integrated a new payment gateway into its e-portal, Insurance Intermediaries Connect (IIC).