LIC shares have surged 16% this July on the BSE, hitting Rs 1,143.80, and are approaching their February 2024 peak of Rs 1,175. This rise is driven by LIC’s improved market share and increased group premiums.

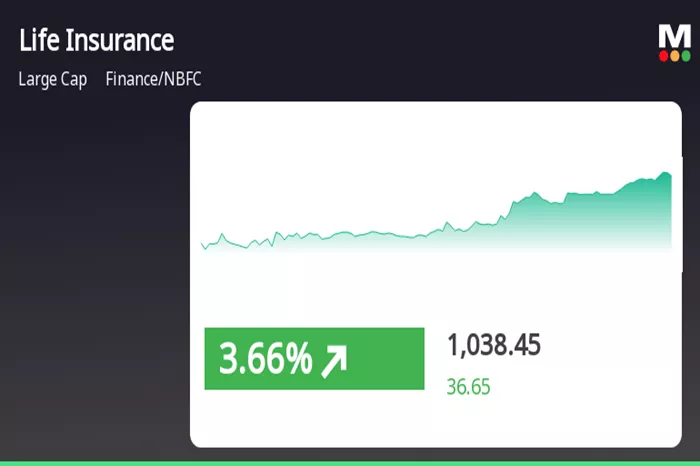

At 10:41 AM on July 22, LIC’s shares were up 2% at Rs 1,130, outpacing the BSE Sensex’s 0.10% increase. The trading volume was high, with 3.3 million shares traded across NSE and BSE.

According to IRDAI, LIC’s market share in Q1FY25 increased to 64.02% from 59.59% in Q4FY24. Although it has decreased from a peak of 68.25% in Q3FY23, LIC remains a major player amid growing competition from private insurers.

The insurance sector saw a 19.7% rise in retail APE in Q1FY25, with private insurers growing by 23.8% and LIC by 12.1%. Emkay Global Financial Services projects a 12-13% growth in Retail APE for FY25, with private players growing faster and LIC expected to grow at 6-8%.