Liability car insurance is a crucial component of auto insurance policies, offering protection against financial losses resulting from accidents for which the insured driver is at fault. In this comprehensive guide, we’ll delve into the intricacies of liability car insurance, from its definition to coverage limits, state requirements, costs, legal implications, and more. Whether you’re a new driver or a seasoned road warrior, understanding liability insurance is essential for safeguarding your finances and assets in the event of an accident.

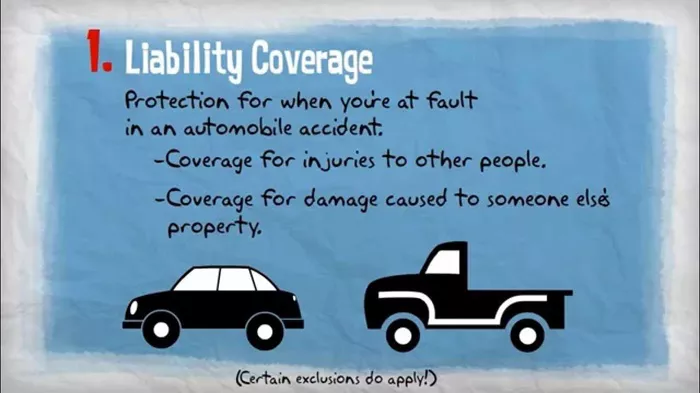

Definition of Liability Car Insurance

Liability insurance is a mandatory aspect of car insurance in most states. It covers injury and damage caused to others in an accident where the insured driver is at fault. Essentially, it provides financial protection for the other party’s medical bills, vehicle repairs, and other related expenses.

Types of Coverage

Liability insurance consists of two main components: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, rehabilitation costs, and lost wages for individuals injured in an accident caused by the insured driver. Property damage liability, on the other hand, pays for repairs or replacement of vehicles and other property damaged in the accident.

Coverage Limits

Coverage limits are typically represented as a series of three numbers, such as 25/50/25. The first number indicates the maximum amount (in thousands of dollars) the insurer will pay per person for bodily injury. The second number represents the total bodily injury coverage per accident, and the third number is the property damage liability limit per accident. For example, in a policy with limits of 25/50/25, the insurer would pay a maximum of $25,000 per person for bodily injury, up to $50,000 total for all injuries in the accident, and $25,000 for property damage.

State Requirements

Each state sets minimum liability coverage levels that drivers must carry to legally operate a vehicle. These requirements vary widely, with some states mandating higher coverage limits than others. It’s essential to familiarize yourself with your state’s minimum requirements to ensure compliance with the law.

Cost of Liability Insurance

Liability insurance is typically the most expensive portion of an auto insurance policy. Several factors influence the cost, including the driver’s age, driving history, location, vehicle type, and coverage limits. Generally, higher coverage limits result in higher premiums, but they also offer greater financial protection in the event of a serious accident.

Legal Costs

In addition to covering medical and property expenses, liability insurance often includes coverage for legal-related costs if the insured driver is sued following an accident. This can include attorney fees, court costs, and settlements or judgments against the insured.

Financial Protection

Liability insurance plays a crucial role in protecting the insured’s finances and assets in case of an at-fault accident. Without adequate coverage, drivers risk facing substantial out-of-pocket expenses, lawsuits, and even bankruptcy if they cannot afford to pay for damages and legal fees.

How to Choose Limits

When selecting liability limits, it’s essential to strike a balance between adequate protection and affordability. Consider factors such as your assets, income, and potential liabilities in the event of an accident. While state minimums provide basic coverage, they may not be sufficient to fully protect your finances in a serious collision. Consult with your insurance agent to determine appropriate limits based on your individual circumstances.

Claim Process

Filing a claim under liability insurance typically involves contacting your insurance provider and providing details of the accident, including the date, location, and parties involved. Your insurer will investigate the claim, assess liability, and negotiate settlements with the other party’s insurance company or legal representatives. It’s essential to cooperate fully with your insurer and provide any requested documentation to expedite the claims process.

Policy Review and Updates

Finally, it’s crucial to regularly review and update your liability coverage to keep pace with changing laws and personal circumstances. As your financial situation evolves and state requirements shift, your insurance needs may change as well. By staying proactive and maintaining adequate coverage, you can ensure ongoing financial protection on the road.

Conclusion

Liability car insurance is a fundamental aspect of responsible vehicle ownership, offering essential protection against the financial consequences of at-fault accidents. By understanding the nuances of liability insurance, selecting appropriate coverage limits, and staying informed about state requirements and policy updates, drivers can drive with confidence, knowing they have reliable financial protection in place.

FAQs about Insurance

1. What is the amount you owe before insurance will cover the rest of the bill?

This amount is known as the deductible. It’s the portion of eligible expenses you must pay out of pocket before your insurance coverage kicks in. Once you’ve met your deductible, your insurance will typically cover a percentage of the remaining costs, depending on your policy’s terms.

2. What is the amount paid for a policyholder to maintain an insurance policy?

The amount paid to maintain an insurance policy is called the premium. It’s usually paid on a monthly, quarterly, or annual basis to keep your coverage active. Premiums vary based on factors such as the type of insurance, coverage limits, deductibles, and the policyholder’s risk profile.

3. How does insurance work?

Insurance works by pooling risks among a group of policyholders. When you purchase insurance, you’re essentially transferring the financial risk of certain events (like accidents, illnesses, or property damage) to the insurance company in exchange for premium payments. If you experience a covered loss, the insurance company pays out benefits to help offset your expenses, up to the limits of your policy.

4. What is the coverage limit?

The coverage limit, also known as the policy limit, is the maximum amount your insurance company will pay for covered losses during a specific policy period. It can apply to different aspects of your policy, such as liability coverage, property damage, or medical expenses. Once you reach your coverage limit, you’re responsible for any additional costs beyond that amount.

You Might Be Interested In