Health insurance is a crucial consideration for anyone planning a journey, whether it’s a short vacation, a business trip, or an extended adventure abroad. The question of whether to secure health insurance before traveling is pivotal, ensuring financial security and access to medical care in unfamiliar environments. In this detailed article, we will delve into the importance of health insurance for travelers, the types of coverage available, and essential factors to consider when selecting the right policy for your travel needs.

Why Health Insurance Matters When Traveling

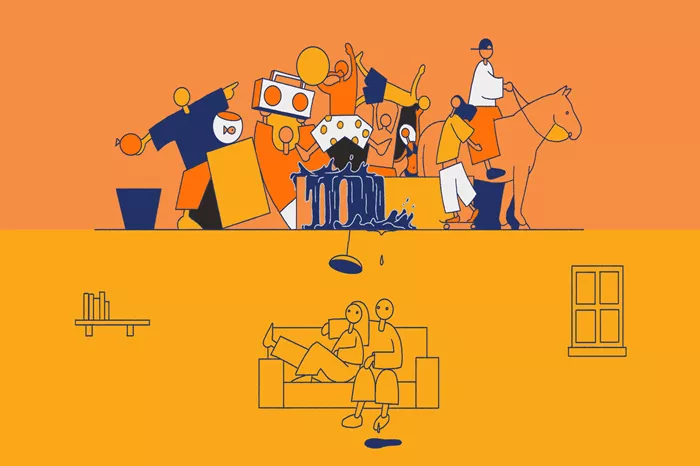

Traveling exposes individuals to unfamiliar environments, varying climates, and potential health risks. While no one anticipates falling ill or encountering accidents during their travels, having adequate health insurance can mitigate financial burdens and provide access to quality medical care when needed most. Here’s why health insurance is essential for travelers:

Coverage for Medical Emergencies: Unexpected illnesses or injuries can occur at any time. Health insurance ensures you receive prompt medical attention without worrying about exorbitant hospital bills.

Emergency Situations: Accidents and sudden health issues can happen anywhere, and having insurance means you can get help quickly without financial stress.

Peace of Mind: Knowing you have coverage can relieve anxiety, allowing you to enjoy your trip without worrying about potential medical costs.

Access to Healthcare Services: In some countries, access to healthcare services may be limited without insurance. Having coverage ensures you can receive necessary treatments and medications.

Medical Facilities Abroad: In unfamiliar places, finding adequate medical care can be challenging without local knowledge or language skills. Insurance can help navigate these situations.

Prescription Medications: Insurance coverage can help cover the cost of medications prescribed during travel, ensuring continuity of treatment.

Financial Protection: Medical emergencies abroad can lead to substantial expenses. Health insurance provides financial protection against unexpected healthcare costs.

Hospitalization Costs: Insurance covers hospital stays and related expenses, preventing large bills that could impact your travel budget.

Repatriation: In severe cases, insurance may cover the cost of returning home for treatment, ensuring you receive care in familiar surroundings.

Types of Health Insurance for Travelers

Travelers have several options when it comes to health insurance, each tailored to different needs and travel scenarios. Understanding these types of insurance can help you choose the coverage that best fits your travel plans:

Travel Medical Insurance:

Designed for short-term travelers, typically ranging from a few days to several months.

Covers emergency medical expenses, hospitalizations, and emergency medical evacuations during the trip.

Provides financial protection against unforeseen medical costs while traveling abroad.

Comprehensive Travel Insurance:

Offers broader coverage beyond medical emergencies.

Includes benefits such as trip cancellation, trip interruption, lost luggage, and travel delays.

Ideal for travelers seeking comprehensive protection against various travel-related risks.

International Health Insurance:

Suitable for expatriates, long-term travelers, or individuals living abroad for extended periods.

Provides comprehensive medical coverage across multiple countries or regions.

Includes benefits like routine healthcare, preventive services, and emergency medical evacuations.

Trip Cancellation Insurance:

Covers non-refundable trip expenses if you need to cancel your trip due to covered reasons.

Offers reimbursement for prepaid travel costs, including flights, accommodations, and tour packages.

Helps mitigate financial losses caused by unexpected cancellations or disruptions.

Evacuation Insurance:

Covers emergency evacuations due to medical emergencies, natural disasters, or political unrest.

Ensures safe transportation to the nearest adequate medical facility or back to your home country for treatment.

Essential for travelers visiting remote or high-risk destinations where local healthcare may be limited.

Expat Health Insurance:

Designed for individuals living or working abroad for an extended period.

Provides comprehensive healthcare coverage, including routine medical care, specialist visits, and hospitalizations.

Offers flexibility to choose healthcare providers globally and access medical services in different languages.

Choosing the Right Insurance for Your Travel Needs

Selecting the appropriate health insurance depends on factors such as your destination, travel duration, health condition, and specific coverage needs. Evaluate each type of insurance based on its benefits, limitations, and exclusions to ensure you have adequate protection throughout your journey. Whether traveling for leisure, business, or relocation, investing in suitable health insurance enhances your safety, peace of mind, and overall travel experience.

See Also: Top 5 Best Medical Travel Insurance

Factors to Consider When Choosing Health Insurance for Travel

Selecting the right health insurance for your travel needs involves evaluating several key factors to ensure comprehensive coverage and financial protection:

Destination and Travel Itinerary:

Healthcare Infrastructure: Research the quality of healthcare facilities and medical services available at your destination. Consider countries with reliable healthcare systems and accessible medical facilities.

Health Risks: Assess potential health risks associated with your destination, such as prevalent diseases, climate-related illnesses, or safety concerns. Choose insurance that covers treatments specific to these risks.

Duration and Type of Travel:

Short-term vs. Long-term Coverage: Determine the duration of your trip—short-term travel insurance covers brief periods, while long-term plans are suitable for extended stays or frequent travel.

Type of Travel Activities: Consider the activities planned during your trip, such as adventure sports, hiking, or water activities. Ensure your insurance covers injuries or accidents related to these activities.

Medical Coverage and Benefits:

Coverage Limits: Review coverage limits for medical expenses, hospitalizations, and emergency medical evacuations. Ensure the policy offers adequate financial protection against unforeseen healthcare costs.

Pre-existing Conditions: Disclose any pre-existing medical conditions to your insurer. Verify if the policy covers treatments related to pre-existing conditions or if additional coverage is necessary.

Policy Exclusions and Limitations:

Exclusions: Understand policy exclusions, such as high-risk activities, pre-existing conditions, or specific medical treatments not covered by the insurance. Clarify any limitations that may affect your coverage.

Cost and Affordability:

Premiums and Deductibles: Compare insurance premiums, deductibles, and out-of-pocket expenses. Balance cost considerations with the extent of coverage and benefits provided by the insurance policy.

Additional Benefits and Services:

Additional Coverage: Evaluate additional benefits, such as trip cancellation/interruption insurance, lost baggage reimbursement, or 24/7 travel assistance services.

Emergency Services: Check if the insurance includes emergency medical services, medical repatriation, or coordination with local healthcare providers in case of emergencies.

Benefits of Travel Insurance Beyond Health Coverage

Travel insurance offers a range of benefits that extend beyond medical coverage, enhancing the overall travel experience and providing financial protection against various unforeseen circumstances. Here are key benefits to consider:

Trip Cancellation and Interruption Coverage:

Reimbursement: Provides reimbursement for non-refundable trip expenses if you need to cancel or cut short your trip due to covered reasons, such as illness, injury, or unexpected emergencies.

Financial Protection: Helps recover prepaid travel costs, including flights, accommodations, and tour packages, reducing financial losses caused by trip disruptions.

Baggage Loss and Delay Compensation:

Lost Baggage: Offers compensation for lost, stolen, or damaged luggage during travel. Helps replace essential belongings and reduces inconvenience caused by baggage mishaps.

Baggage Delay: Provides reimbursement for essential items purchased due to delayed baggage delivery, ensuring continuity of travel plans without additional expenses.

Travel Delay and Missed Connections:

Travel Delay: Covers additional expenses incurred due to flight delays or cancellations, such as meals and accommodation. Helps manage unexpected costs and maintains travel schedules.

Missed Connections: Assists in arranging alternative transportation or accommodations if you miss a connecting flight or transportation due to unforeseen circumstances.

Emergency Medical Evacuation and Repatriation:

Medical Evacuation: Arranges emergency transportation to the nearest adequate medical facility or back to your home country for treatment. Ensures access to specialized medical care in critical situations.

Repatriation of Remains: Covers the cost of returning remains to your home country in case of death during travel. Provides support and assistance to families during difficult circumstances.

24/7 Travel Assistance Services:

Emergency Assistance: Offers round-the-clock access to travel assistance services, including medical referrals, legal assistance, and language translation services.

Travel Support: Provides guidance and support in navigating unfamiliar locations, local healthcare systems, and emergency situations abroad.

Conclusion

In conclusion, while health insurance may not be legally mandatory for all travelers, its significance cannot be overstated. Investing in comprehensive health insurance tailored to your travel plans ensures financial security, access to quality healthcare, and peace of mind throughout your journey. Whether exploring local destinations or venturing abroad, prioritize your well-being by securing adequate health insurance coverage before embarking on your next adventure.